The Karex Group is principally engaged in the manufacturing and sale of condoms, sterile catheters, latex probe covers, lubricating jelly and other rubber products.

The Group’s products are principally sold in the commercial, tender and own brand manufacturers markets. The commercial market is where the Group manufactures condoms for other brand owners (original equipment manufacturer). The tender market is where the Group tenders to institutional buyers to manufacture condoms for them. Besides that, the Group also manufactures condoms under its own brands, namely “Atlas”, “Carex”, “INNO” and “ONE” which are mainly exported to Africa and Asia countries.

(Karex is another one of the export stocks which shone during the end of 2015, this is because of its main exports in Africa)

With the Malaysian Ringgit still at its 17-year low, this would show that Karex is able to strongly benefit from the increased demand due to its weakening currency.

Overview

For Karex, we would be focusing mainly on its production on condoms. This is due to condoms denominating more than 90% of the group’s total revenue. For those who do not know, condoms are made from latex, this would mean that the cost of latex would be directly affecting the cost of production of Karex.

The chart above shows that since 2011, there had been a persistent decrease in rubber prices. Karex had acquired the privilege to reap the low price of rubber throughout the years.

Financial analysis

As I looked through the company’s website, I was honestly impressed with the way they had presented their financial information. This has helped me a lot in compiling the data for this post.

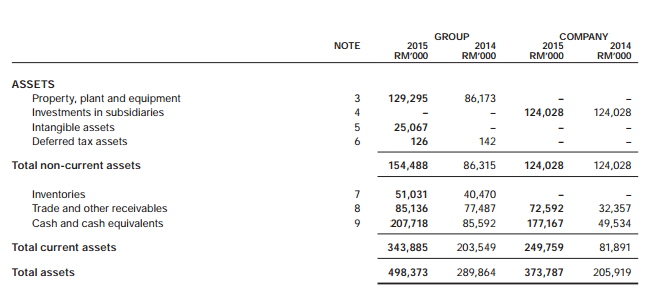

Firstly, we are going to look at its financial statements. One thing to highlight about the company is that it is highly liquid. This is due to having almost half of its total assets in CASH. Try to take note of the amount of cash the company has as it would help in understanding the strong financials of the business later.

Now lets take a look at the company’s cash flow. With a healthy amount of cash, we also see that there had been a yearly increase in cash flow per share in the company.

Not only that, in its 2015 financial report, the company had only recorded its short and long term liabilities at only RM 66,000 million. That’s less than half of what the company had in cash! I would say that the company is financially secure as of the short and medium term in the future.

Looking at the company’s growth rate, we are able to notice consistent growth throughout the past 5 years. However, do note that while the company pays out dividends, it still has a long way to go at its current dividend yield of merely 0.63%.

Conclusion

As it stands, I can see that Karex is a fundamentally strong company. But I would not recommend to buy it due to the stock being overbought as of late. For now, I am keeping this company in my watchlist and hope that I can buy in at a lower price in the near future.

DISCLAIMER: THIS IS NOT A RECOMMENDATION TO BUY OR SELL. IF YOU ARE BUYING OR SELLING, DO IT AT YOUR OWN RISK.